How does the bank of England base rate change affect equity release?

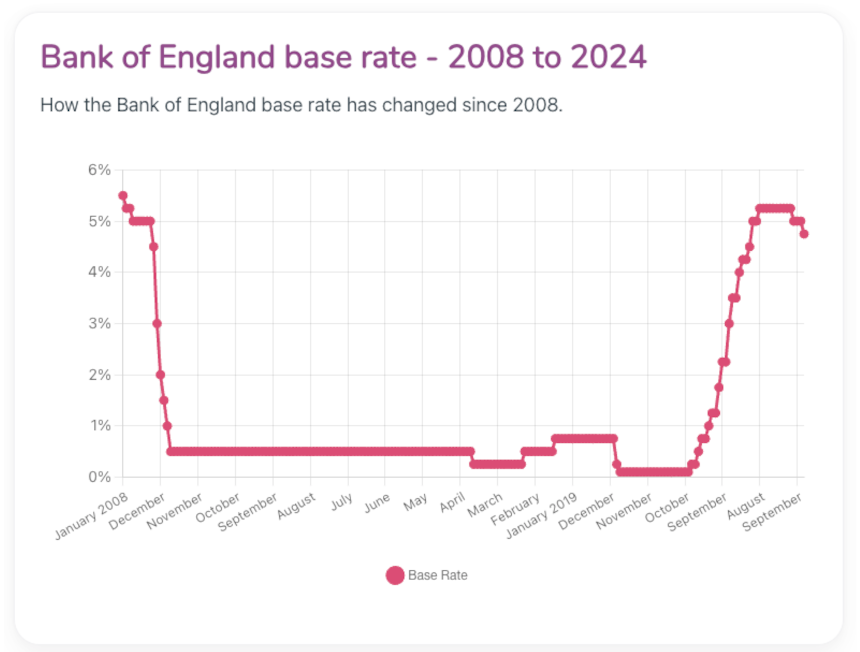

On Thursday 7th November, the Bank of England cut the base rate to 4.75%. The base rate hit an all-time low of 0.1% in March 2020, and then started gradually increasing from December 2021 up to 5.25% in August 2023. This most recent change is the second time that the rate has been cut in 2024.

Source: bankofengland.co.uk

Source: Money.co.uk

We know that over 55’s considering taking equity from their home may have questions about rates and the impact of the Bank of England base rate change, so we asked our resident expert, Michael Hush, Head of Product at Age Partnership what he thought.

What impact does the base rate have on equity release rates

There may be an expectation that equity release rates will begin to fall gradually after news that the base rate has been reduced for a second time this year. However, they are influenced by many factors so it is difficult to determine what will happen.

What other economic factors impact equity release rates

Gilts, which are UK government bonds, are typically used to price equity release rates. Gilt rates move regularly in line with a variety of different market factors both within the UK market as well as other global factors such as levels of government borrowing, future rate outlook and demand for this asset from financial markets. The demand for equity release borrowing will also affect rates, and each individual lender has the freedom to adjust their rates in order to remain competitive.

When is the right time to take out equity release?

This is really dependent on your personal circumstances. There are lots of different reasons why people choose to release equity from their homes. Some people consolidate debts and pay off their mortgage, to enable them to have more disposable income each month. Others go on a dream vacation or make improvements to their home. Whatever your reason for looking into equity release you will need to speak with a specialist adviser who can talk you through the process and the implications and help you to work out whether now is the right time.

What if rates go down after I take out equity release?

Lifetime Mortgage rates are typically fixed (or in some cases capped) for life of the plan. As the rates available on the market fluctuate, this means that there is a chance that they could rise or fall after you have taken out your product. It’s worth noting that an equity release plan can be reviewed regularly and can be moved to another product if it’s found that your position can be improved. The first review can usually be done after 12 months of holding the plan, and the plan can be reviewed again in the future. Being able to change your plan will depend upon whether you qualify for the latest plan developments, the amount outstanding on your equity release plan including interest that has accrued and any potential early repayment charges that may be applicable.

What if I only want some of the money now and some later?

It’s important that you only borrow what you need using equity release as the interest on the loan is compounded meaning that you will pay interest on interest going forward. If you need some money now and some in the future there are a couple of ways to do this.

- Take out a drawdown product which means that you can choose to have some of the funds immediately and the rest when you need them. This means you won’t be charged interest on the remaining funds until you decide to withdraw them. The interest rate applicable to these funds will depend on the rates available at the time of withdrawal.

- Alternatively, you can take out a loan for the amount you need now and then apply for additional borrowing in the future if you require it, with the interest rate applicable at that time, however there is no guarantee that further borrowing will be available. Further advice will be required and, if completed, an advice fee will be applicable.

What does the future hold for Equity Release rates?

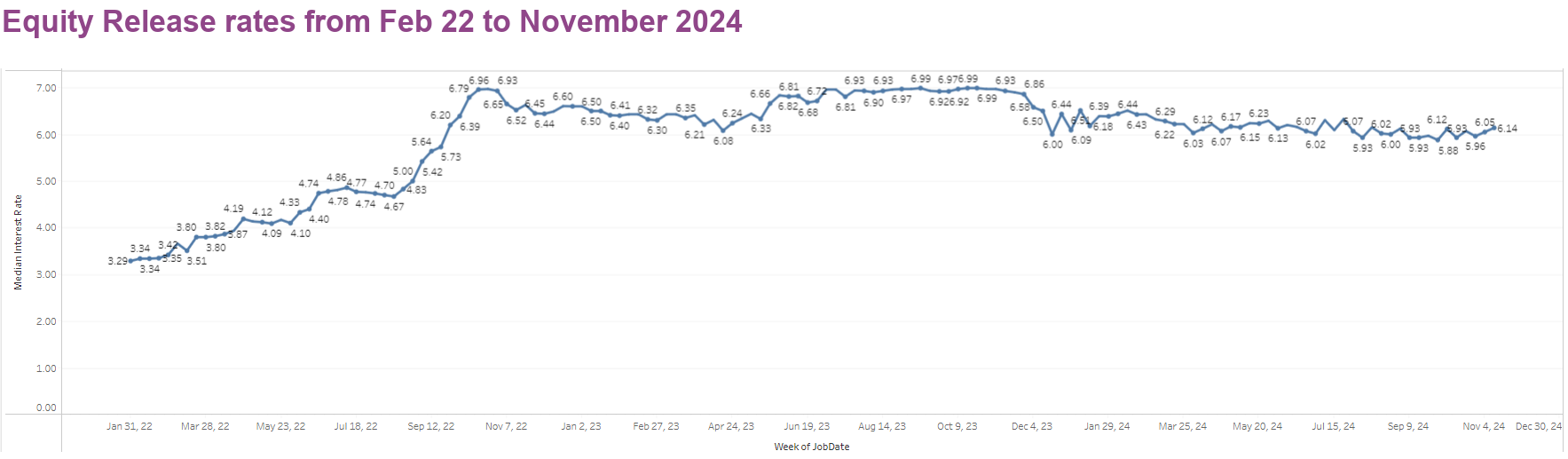

The graph shows how equity release rates have changed over the past two years. Given the wide range of factors that influence these rates it is very difficult to predict the future.

The first step to finding out about whether equity release is right for you is to have an appointment with a qualified adviser. They will do a full analysis of your personal situation and help you to understand whether equity release is right for you. They can also let you know how much you would be able to borrow and what the interest rates are at that point in time.

Age Partnership is a leading equity release broker and can advise on plans from a panel of leading lenders. You can arrange an appointment with an adviser here.

About equity release

Equity release may involve a home reversion plan or lifetime mortgage which is secured against your property and will reduce the value of your estate and impact funding long-term care. To understand the features and risks ask for a personalised illustration. Equity release requires paying off any existing mortgage. Any money released, plus accrued interest would be repaid upon death, or moving into long-term care. We provide initial advice for free and without obligation. Only if your case completes would our advice fee of £1,895 be payable. Other lender and solicitor fees may apply.

Age Partnership is a trading name of Age Partnership Limited, which is authorised and regulated by the Financial Conduct Authority. FCA registered number 425432. Company registered in England and Wales No. 5265969. VAT registration number 162 9355 92. Registered address, 2200 Century Way, Thorpe Park, Leeds, LS15 8ZB.

Correct at the time of publication.