What are Fixed-Term Annuities?

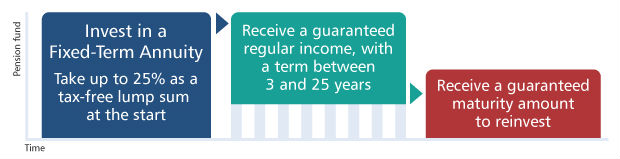

A Fixed-Term Annuity provides you with a regular income for a fixed-period, generally between 1 and 25 years. At the end of the term, a guaranteed maturity value will be available. You’ll be able to use the maturity value to choose another pension-income option and, as it’s guaranteed, you’ll know the exact value you’ll receive from the start.

These plans offer a combination of security, as you know how much you will be receiving over the course of the plan and the maturity value, and flexibility, as you have control over what to do with your fund once the term ends.

You select the level of income you take over the course of the term, as well as making some choices such as whether or not you want the income to continue for a spouse in the event that you were to die first. Based on these factors and any additional investment growth, your guaranteed maturity amount will be calculated.

This flexibility means that you may be able to secure a better level of income after the term if, during the fixed-term, pension annuity rates improve, or if changes to your health mean that you would now qualify for an enhanced annuity.

However, with this flexibility comes some risk in that you may not be able to secure the same level of income from your pension savings at the end of the term as you would have done at the start. For example, pension annuity rates may be lower than they were when you started the fixed-term.

How does this plan work?

Fixed-Term Annuities at Age Partnership

Our service allows you to compare the fixed-term annuities we offer. We can take you through the range of features on offer and provide you with information to help you choose:

- ✔The length of the term that suits your needs.

- ✔The level of income that you choose – the more you take, the less you will have available at the end of the term.

Once you’ve made these decisions, we’ll be able to give you the guaranteed maturity amount on offer from each provider so that you can compare all of your options like-for-like before you make a decision.

Alternatively, you could speak to a Financial Advisor who would be happy to make a recommendation to you about fixed-term annuities and your pension-income options.

With a Fixed-Term Annuity the maturing fund may be guaranteed, however it’s uncertain what it will provide as an ongoing income, which may produce a lower income after the fixed-term period has ended.