How could equity release help me?

You may also be wondering if equity release is a good idea? Equity release can provide you with the money to enable you to make choices about how you live your life.

You don’t have to choose one thing to spend your money on, you may have a few aims for the money that you release.

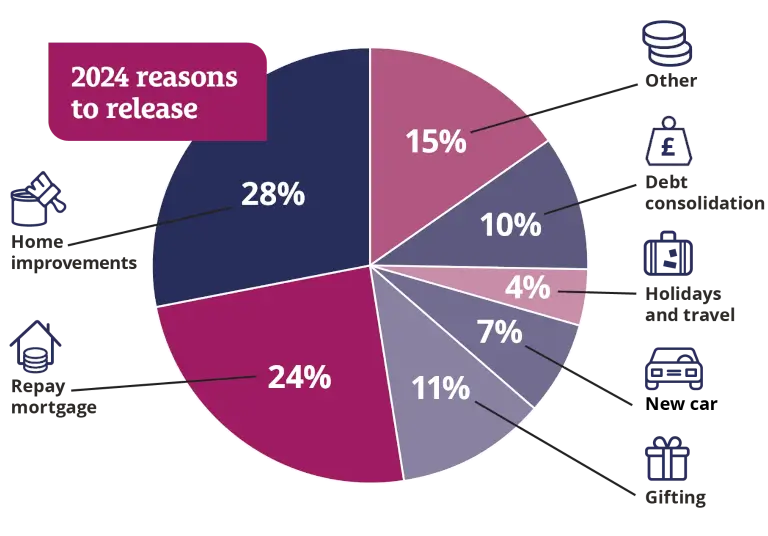

We asked our customers why they’d made the decision, and this is what they told us:

How much tax-free cash can you unlock from your home?

Use our free calculator to get a view of how much tax-free cash you could release to help you live your life, your way.

By supplying your email address, you are confirming that you are happy for us to contact you via email regarding products and services relevant to your enquiry.

A few things to think about

Equity release will involve a home reversion plan or a lifetime mortgage, which is secured against your property and will reduce the value of your estate and impact funding long-term care.. You can read more about the different types of equity release plans here and if you want more detail we can provide you with a personalised illustration to explain exactly what equity release could mean for you and will outline the features and risks.

You must take financial advice before proceeding with equity release. It’s important that you make the right decision. That’s why we provide our initial advice for free and without obligation. Only if your case completes would our advice fee of £1,895 be payable. Other lender and solicitor fees may apply.

You will need to pay off any existing mortgage or secured loan that you have. You can use some of the money raised through equity release to do this.

Another consideration is that equity release interest is compounded, so you pay interest on interest. The money you release, plus the accrued interest is then repaid when you die or move into long-term care.

Equity release may have an impact on your entitlement to means-tested benefits now and in the future.

I’d like flexible access to my money

If you’re looking for flexible access to your money, a drawdown lifetime mortgage may be a suitable solution for you, as you could release smaller amounts over time.

I need access to a large chunk of money

If you would like to access a pot of money, perhaps for a one-off purchase or to help out family members, then a lump sum lifetime mortgage could be for you.

Popular questions

You’re talking to the people who know.

We will talk you through all your options and explain all the pros and cons of equity release, so that you’re fully informed.

This will include discussing alternative options you should consider; including other lending options and mortgages (such as Retirement Interest Only), accessing pension savings or other assets, downsizing, taking in a lodger or using family help, state benefits or grants.

Our service is about finding out if equity release is a good fit for you, and only then will we find the best equity release plan for your individual needs.

Our promise to you...

- You will be assigned a dedicated advisor who will guide you through the process from start to finish.

- Equity release will only be recommended if it’s suitable for you.

- We will search a range of plans from multiple lenders to find the best solution for you.

- The plan that we recommend to you will be protected by the safeguards of the Equity Release Council.

- You will receive a bespoke recommendation document to read at your leisure.