Can I make repayments if I take out Equity Release?

Yes, it is possible to make repayments if you take out one type of Equity Release. Equity Release is a term used for products that enable you to release equity from your home. There are two types of Equity Release products, Home Reversion and Lifetime Mortgage.

Lifetime Mortgages are the most popular type of Equity Release, and there is an option to make repayments. Home Reversion plans involve you selling some or all of your home, in return for a lump sum of cash. You still have the right to stay in your home rent-free, for as long as you live, but it will be owned by the home reversion lender. This type of Equity Release is only available for those aged 65 and over.

What is a Lifetime Mortgage?

A Lifetime Mortgage (LTM) is a type of Equity Release product that allows homeowners aged 55 or over to release a tax-free lump sum from their home. If there is an outstanding mortgage on the property, this must be repaid as part of the deal. There is no requirement to make repayments, as the loan + accrued interest is repayable on death or when the customer moves into Long Term Care and the house is sold. The interest is compound (which means that you pay interest on interest) meaning that the final repayment amount could be substantially higher than the initial loan.

Can I make repayments on my Lifetime Mortgage?

With a Lifetime Mortgage, repayments are optional. However, if you choose not to make repayments, the interest will roll up quickly over time and could end up being significantly higher than the amount borrowed. If you decide to make repayments the effect of compound interest over time could be significantly reduced.

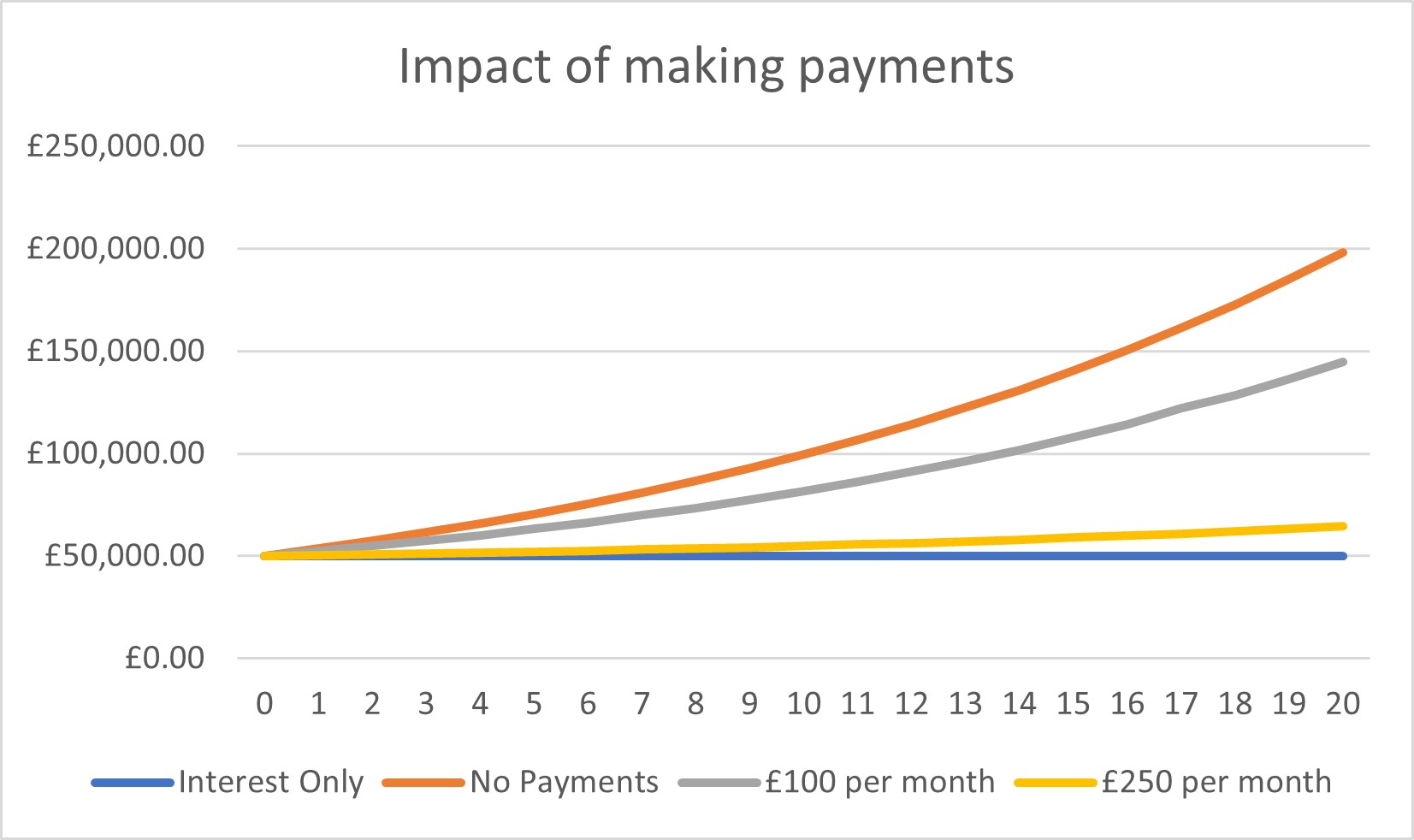

Take a look at the example below which is based on a 69-year-old taking out a Lifetime Mortgage plan at an interest rate of 7.13%. This shows the difference between making no repayments, and repaying £100 per month and £250 per month.

The graph illustrates the difference in the size of the loan over a 20-year period. By making monthly payments of £100 over the 20-year period, a customer could reduce the total debt by £53,456. If they choose to pay £250 per month the reduction in the total debt would be £113,640.

Can I take payment holidays?

Yes, you can choose to take repayment holidays, one of the benefits of a Lifetime Mortgage is its flexibility. Because repayments are optional, you are in control of your repayments, and often people choose to set up a standing order which they can stop and start depending on their own specific needs. You must be aware that interest levels will increase faster when repayments are not being made.

Is there a penalty for making repayments to my Lifetime Mortgage?

You can typically make repayments of up to 10% per year, penalty free. The Equity Release Council (ERC), is a governing body for the Equity Release industry which ensures high standards of products and the protection of homeowners unlocking equity from their home. The ERC have created the following standard which all members must follow “All customers taking out new plans which meet the Equity Release Council standards must have the right to make penalty free payments, subject to lending criteria”. Speak to your adviser about your desire to make repayments and they will ensure that they recommend a product that offers penalty-free options.

Should I take advice on Equity Release?

Releasing equity from your home is a big decision and therefore you must speak to a qualified Equity Release adviser. The advice process is in-depth, to ensure that customers make the decision that is right for their personal circumstances. If the adviser recommends Equity Release, they will ensure that you only borrow enough to meet your objectives, potentially with an option to drawdown extra money later if required.

Age Partnership is the UK’s number 1* Equity Release adviser. We are proud to be a member of the Equity Release Council and we have also won numerous awards during our almost 20 years in the industry, including Investor in customers Gold award for 10 years in a row, and Mortgage Solutions Winner of Best Equity Release Adviser 2022.

Equity Release may involve a home reversion or a lifetime mortgage, which is secured against your property and will reduce the value of your estate and impact funding long-term care. To understand the features and risks, ask for a personalised illustration. It is a requirement of Equity Release that you must repay any existing mortgage that you may have on your home, but you can use some of the money that you release to do this. The money that you release, plus accrued interest will be repaid when you die or move into long-term care.

There are Lifetime Mortgage Plans that may allow you to make voluntary payments subject to certain limits. Early repayment charges may apply above a set value.

Advice is required before proceeding with Equity Release, and Age Partnership can provide you with advice on a range of later life lending options including Equity Release, and other specialist mortgage products designed for the over 55’s. We provide initial advice for free and without obligation. Only if your case completes would our advice fee of £1,895 be payable. Other lender and solicitor fees may apply.

*Based on volume of plans, ISS data 2022

Request a callback or calculate how much you might be able to release.